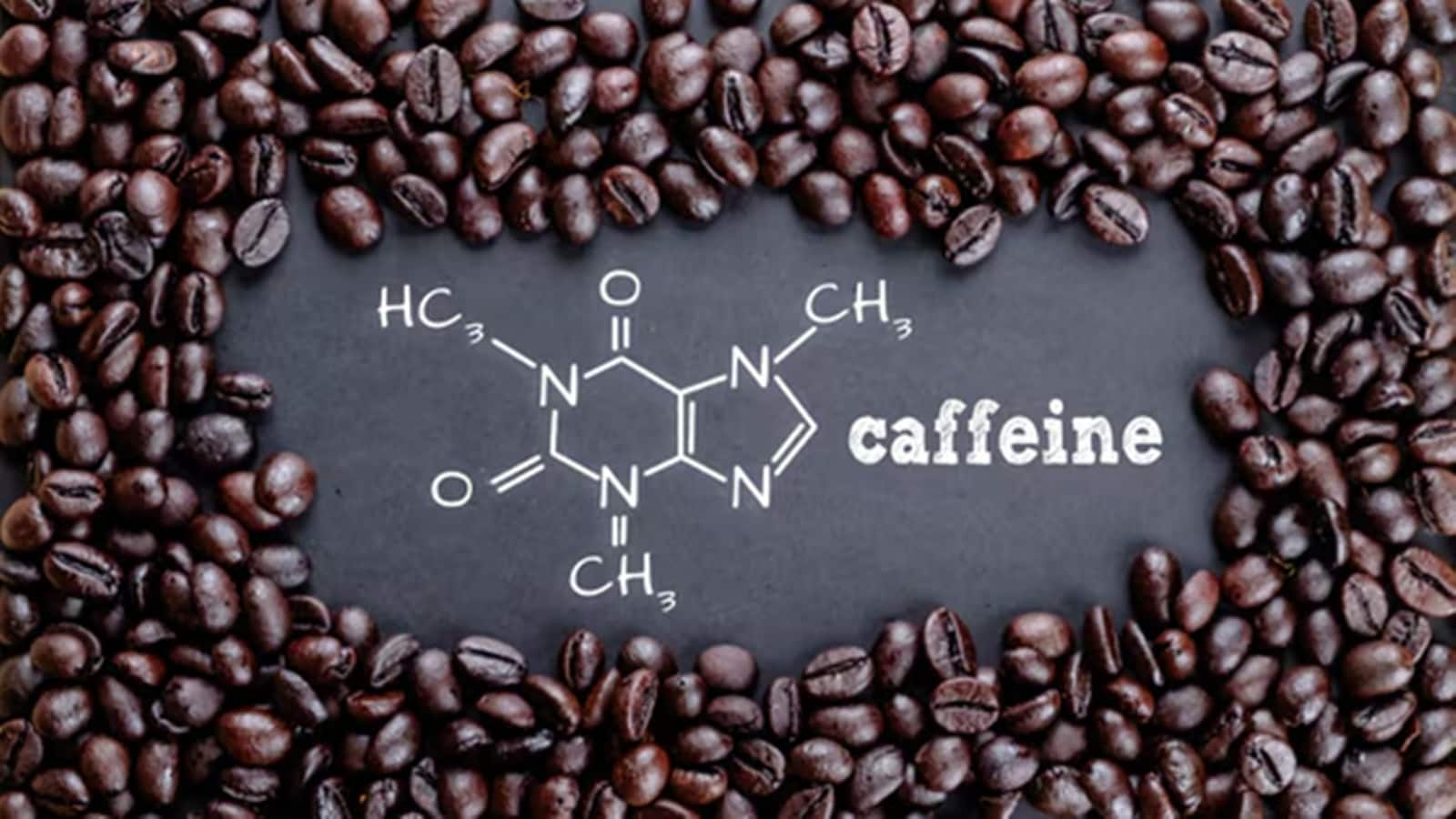

Shri Ahimsa Naturals IPO Itemizing: Shri Ahimsa Naturals shares had been attracted right this moment on NSE SME. Its IPO additionally acquired a bang response and acquired greater than 62 occasions the general. Shares have been issued at a worth of Rs 119 beneath the IPO. Right this moment, it has entered NSE SM at Rs 140.00, that’s, IPO traders acquired an inventory acquire of 17.65 per cent (Shri Ahimsa Naturals Itemizing Achieve). Share and climb up after itemizing. It jumped as much as Rs 144.10 (Shri Ahimsa Naturals Share Worth) i.e. IPO traders are actually 21.09 per cent revenue. This IPO acquired great response from traders and total it was 62.71 occasions subscribed. It had a share reserved for certified Institutional Patrons (QIB) 21.23 occasions, non-institutional traders (NII) share 182.82 occasions and retail traders had been full. Beneath this IPO, new shares of Rs 50.02 crore have been issued. Aside from this, 19,99,200 shares with a face worth of Rs 10 are offered beneath the provide for cell window. The provide on the market cash has been acquired by shareholders promoting share. On the identical time, out of the cash collected by way of new shares, Rs 35 crore will likely be spent on the manufacturing unit of Rs 35 crore subsidiary Mr. Ahimsa Healthcare and the remainder of the cash will likely be spent on frequent company targets. The information associated to the involved Shri Ahimsa Naturals will likely be spent in 1990 Crude makes caffeine. Its merchandise are utilized in meals and drinks, neutralcutics, cosmetics and pharma industries resulting from their well being advantages. It additionally exports to nations like America, Germany, South Korea, UK and Thailand. Speaking concerning the monetary well being of the corporate, it made a web revenue of Rs 11.02 crore in FY 2022 which jumped within the subsequent monetary yr to Rs 38.21 crore within the subsequent monetary yr 2023. Nonetheless, the revenue fell quickly in FY 2024 and it got here to Rs 18.67 crore. Throughout this time, an analogous pattern was seen within the firm’s income. It acquired a income of Rs 58.94 crore in FY 2022, Rs 106.14 crore in FY 2023 and Rs 78.7 crore in FY 2024. Speaking concerning the final monetary yr 2024-25, within the first half April-September 2024 it acquired a web revenue of Rs 9.74 crore and a income of Rs 41.37 crore. ATC Energies IPO Itemizing: Decrease Circuit, ₹ 118 shared as quickly because it was listed.

Supply hyperlink