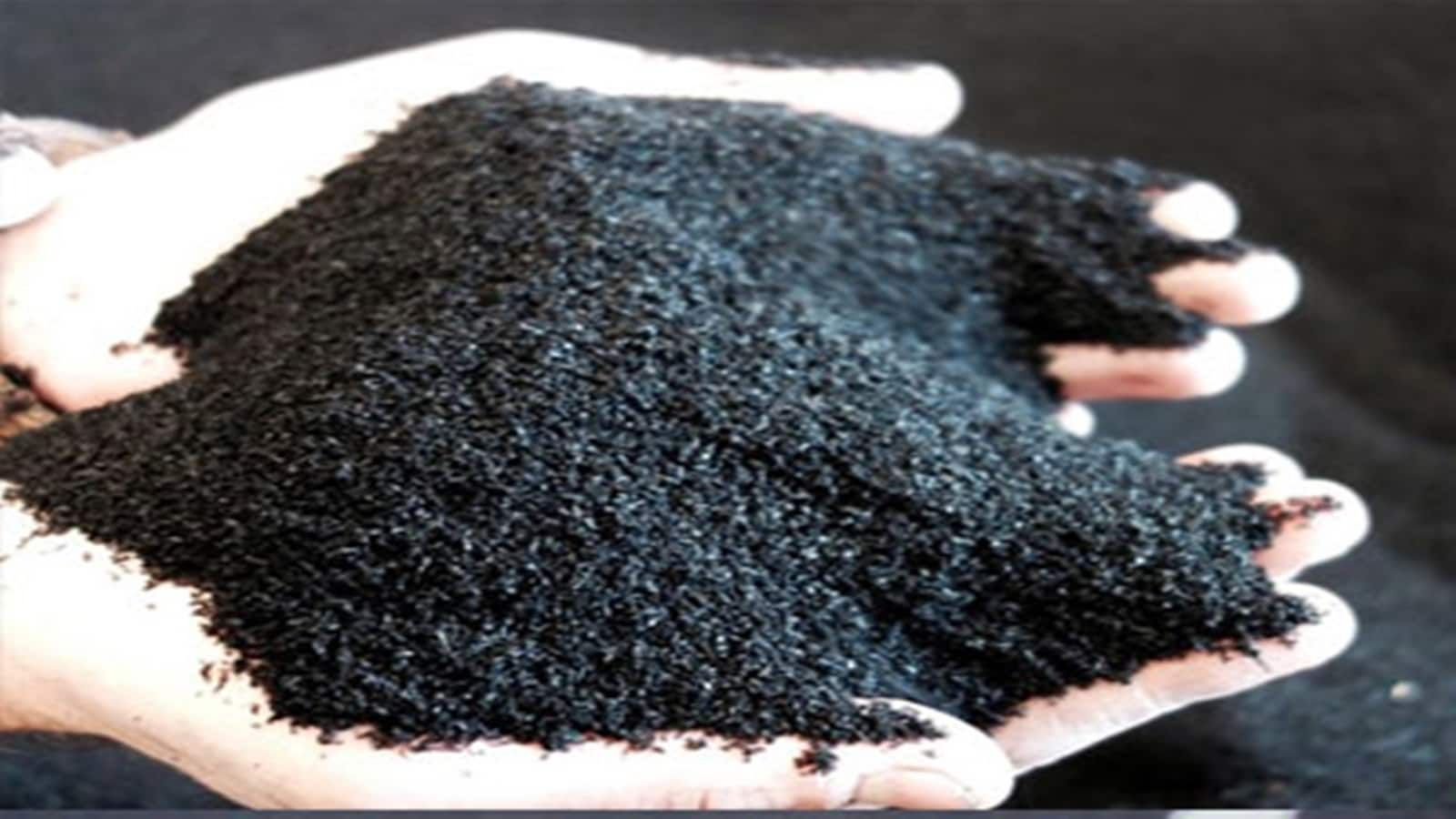

Neptune Petrochemicals IPO Itemizing: Asphalt -making firm Neptune Petrochemicals shares have been drawn to NSE SME right this moment. Its IPO had acquired greater than 4 instances the general general however observe that it couldn’t bid retail buyers because the minimal bid was greater than ₹ 2 lakhs. Shares have been issued at a worth of ₹ 122 beneath IPO. Right now, it has entered ₹ 132.75 on NSE SMe, that’s, IPO buyers bought 8.81% itemizing positive aspects. Share and climb up after itemizing. By leaping it reached the higher circuit of ₹ 139.35 (Neptune Petrochemicals Share Value) and it was closed on it, ie on the finish of the primary enterprise day, IPO buyers are in 14.22% revenue. The subscription was opened from 28–30 Might. For this IPO, the lot dimension was of 1000 shares and was to bid for no less than 2 heaps, so retail buyers i.e. lower than ₹ 2 lakh didn’t make a spot. This IPO acquired good response from buyers and general it was 4.11 instances subscribed. It had 7.12 instances the half reserved for certified Institutional Patrons (QIB) and a pair of.91 instances the share of non-institutional buyers (NII). Underneath this IPO, 60 lakh new shares with face worth of Rs 10 have been issued. Of the cash collected by these shares, ₹ 5.15 crore in further plant and equipment, ₹ 14.75 crore workplace house buy, ₹ 42 crore working capital wants and the remainder of the cash might be spent on widespread company aims. Associated information associated to Neptune Petrochemicals about Neptune Petrochemicals. Makes merchandise. It has three manufacturing items of which Unit 1 is in Ahmedabad in Gujarat, Unit 2 in Haryana and Unit 3 in Assam. The corporate’s merchandise are exported in Nepal and Bhutan. Speaking in regards to the monetary well being of the corporate, it has been strongly strengthened. In FY 2022, it made a internet revenue of ₹ 68 lakh, which jumped within the subsequent monetary yr 2023 to ₹ 10.39 crore and in FY 2024 to ₹ 20.82 crore. Nonetheless, throughout this time there was a fluctuating within the firm’s income. It acquired a income of ₹ 82.16 crore in FY 2022, ₹ 709.31 crore in FY 2023 and ₹ 675.97 crore in FY 2024. Speaking in regards to the final monetary yr 2024-25, in April-December 2024, it has acquired a internet revenue of ₹ 19.47 crore and a income of ₹ 620.16 crore. Disclaimer: Right here info is being supplied right here just for info. It’s crucial to say right here that the funding market available in the market is topic to dangers. All the time seek the advice of specialists earlier than investing cash as an investor. It’s by no means suggested by Moneycontrol to take a position cash right here. SCODA TUBES IPO Itemizing: Flat entry of ₹ 140, test enterprise well being earlier than exiting

Supply hyperlink